[ad_1]

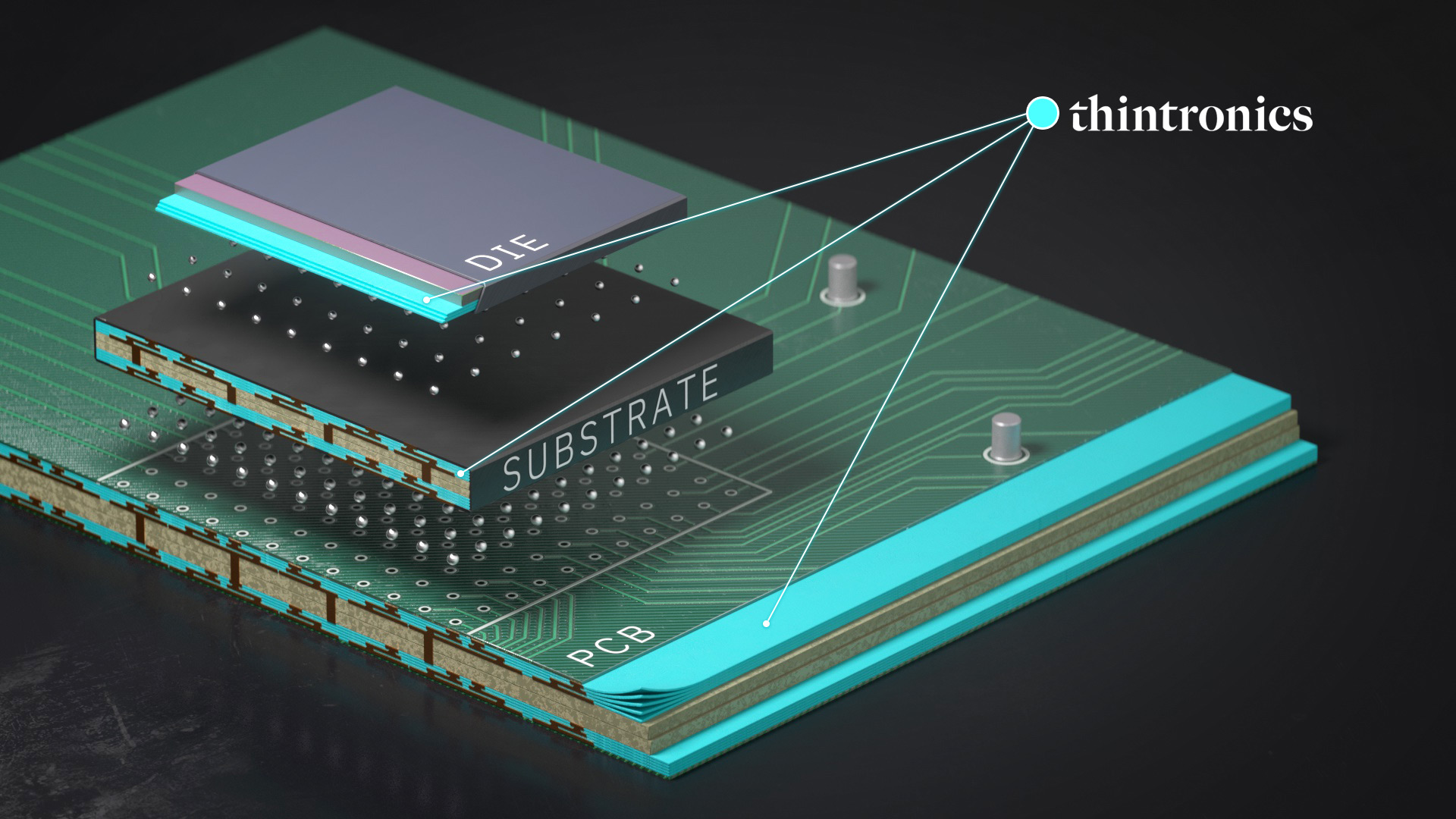

It may be dizzying to attempt to perceive all of the complicated parts of a single pc chip: layers of microscopic parts linked to at least one one other by highways of copper wires, some barely wider than a number of strands of DNA. Nestled between these wires is an insulating materials known as a dielectric, guaranteeing that the wires don’t contact and brief out. Zooming in additional, there’s one specific dielectric positioned between the chip and the construction beneath it; this materials, known as dielectric movie, is produced in sheets as skinny as white blood cells.

For 30 years, a single Japanese firm known as Ajinomoto has made billions producing this specific movie. Opponents have struggled to outdo them, and immediately Ajinomoto has greater than 90% of the market within the product, which is utilized in all the pieces from laptops to information facilities.

However now, a startup primarily based in Berkeley, California, is embarking on a herculean effort to dethrone Ajinomoto and produce this small slice of the chipmaking provide chain again to the US.

Thintronics is promising a product purpose-built for the computing calls for of the AI period—a collection of recent supplies that the corporate claims have larger insulating properties and, if adopted, may imply information facilities with sooner computing speeds and decrease power prices.

The corporate is on the forefront of a coming wave of recent US-based corporations, spurred by the $280 billion CHIPS and Science Act, that’s in search of to carve out a portion of the semiconductor sector, which has turn into dominated by only a handful of worldwide gamers. However to succeed, Thintronics and its friends should overcome an online of challenges—fixing technical issues, disrupting long-standing trade relationships, and persuading world semiconductor titans to accommodate new suppliers.

“Inventing new supplies platforms and getting them into the world could be very troublesome,” Thintronics founder and CEO Stefan Pastine says. It’s “not for the faint of coronary heart.”

The insulator bottleneck

Should you acknowledge the title Ajinomoto, you’re in all probability stunned to listen to it performs a important position within the chip sector: the corporate is best often known as the world’s main provider of MSG seasoning powder. Within the Nineties, Ajinomoto found {that a} by-product of MSG made an important insulator, and it has loved a close to monopoly within the area of interest materials ever since.

However Ajinomoto doesn’t make any of the opposite components that go into chips. In reality, the insulating supplies in chips depend on dispersed provide chains: one layer makes use of supplies from Ajinomoto, one other makes use of materials from one other firm, and so forth, with not one of the layers optimized to work in tandem. The ensuing system works okay when information is being transmitted over brief paths, however over longer distances, like between chips, weak insulators act as a bottleneck, losing power and slowing down computing speeds. That’s lately turn into a rising concern, particularly as the size of AI coaching will get dearer and consumes eye-popping quantities of power. (Ajinomoto didn’t reply to requests for remark.)

None of this made a lot sense to Pastine, a chemist who bought his earlier firm, which specialised in recycling arduous plastics, to an industrial chemical compounds firm in 2019. Round that point, he began to imagine that the chemical compounds trade might be sluggish to innovate, and he thought the identical sample was conserving chipmakers from discovering higher insulating supplies. Within the chip trade, he says, insulators have “type of been checked out because the redheaded stepchild”—they haven’t seen the progress made with transistors and different chip parts.

He launched Thintronics that very same yr, with the hope that cracking the code on a greater insulator may present information facilities with sooner computing speeds at decrease prices. That concept wasn’t groundbreaking—new insulators are always being researched and deployed—however Pastine believed that he may discover the appropriate chemistry to ship a breakthrough.

Thintronics says it is going to manufacture totally different insulators for all layers of the chip, for a system designed to swap into present manufacturing strains. Pastine tells me the supplies at the moment are being examined with plenty of trade gamers. However he declined to supply names, citing nondisclosure agreements, and equally wouldn’t share particulars of the method.

With out extra particulars, it’s arduous to say precisely how properly the Thintronics supplies examine with competing merchandise. The corporate lately examined its supplies’ Dk values, that are a measure of how efficient an insulator a fabric is. Venky Sundaram, a researcher who has based a number of semiconductor startups however shouldn’t be concerned with Thintronics, reviewed the outcomes. A few of Thintronics’ numbers had been pretty common, he says, however their most spectacular Dk worth is much better than something obtainable immediately.

A rocky highway forward

Thintronics’ imaginative and prescient has already garnered some help. The corporate acquired a $20 million Sequence A funding spherical in March, led by enterprise capital corporations Translink and Maverick, in addition to a grant from the US Nationwide Science Basis.

The corporate can be in search of funding from the CHIPS Act. Signed into regulation by President Joe Biden in 2022, it’s designed to spice up corporations like Thintronics with a purpose to carry semiconductor manufacturing again to American corporations and cut back reliance on overseas suppliers. A yr after it grew to become regulation, the administration stated that greater than 450 corporations had submitted statements of curiosity to obtain CHIPS funding for work throughout the sector.

The majority of funding from the laws is destined for large-scale manufacturing amenities, like these operated by Intel in New Mexico and Taiwan Semiconductor Manufacturing Company (TSMC) in Arizona. However US Secretary of Commerce Gina Raimondo has stated she’d wish to see smaller corporations obtain funding as properly, particularly within the supplies house. In February, purposes opened for a pool of $300 million earmarked particularly for supplies innovation. Whereas Thintronics declined to say how a lot funding it was in search of or from which applications, the corporate does see the CHIPS Act as a serious tailwind.

However constructing a home provide chain for chips—a product that presently is dependent upon dozens of corporations across the globe—will imply reversing a long time of specialization by totally different nations. And trade specialists say it will likely be troublesome to problem immediately’s dominant insulator suppliers, who’ve usually needed to adapt to fend off new competitors.

“Ajinomoto has been a 90-plus-percent-market-share materials for greater than twenty years,” says Sundaram. “That is unheard-of in most companies, and you may think about they didn’t get there by not altering.”

One large problem is that the dominant producers have decades-long relationships with chip designers like Nvidia or Superior Micro Units, and with producers like TSMC. Asking these gamers to swap out supplies is an enormous deal.

“The semiconductor trade could be very conservative,” says Larry Zhao, a semiconductor researcher who has labored within the dielectrics trade for greater than 25 years. “They like to make use of the distributors they already know very properly, the place they know the standard.”

One other impediment dealing with Thintronics is technical: insulating supplies, like different chip parts, are held to manufacturing requirements so exact they’re troublesome to grasp. The layers the place Ajinomoto dominates are thinner than a human hair. The fabric should additionally have the ability to settle for tiny holes, which home wires operating vertically by the movie. Each new iteration is a large R&D effort wherein incumbent corporations have the higher hand given their years of expertise, says Sundaram.

If all that is accomplished efficiently in a lab, yet one more hurdle lies forward: the fabric has to retain these properties in a high-volume manufacturing facility, which is the place Sundaram has seen previous efforts fail.

“I’ve suggested a number of materials suppliers over time that attempted to interrupt into [Ajinomoto’s] enterprise and couldn’t succeed,” he says. “All of them ended up having the issue of not being as straightforward to make use of in a high-volume manufacturing line.”

Regardless of all these challenges, one factor could also be working in Thintronics’ favor: US-based tech giants like Microsoft and Meta are making headway in designing their very own chips for the primary time. The plan is to make use of these chips for in-house AI coaching in addition to for the cloud computing capability that they hire out to prospects, each of which would scale back the trade’s reliance on Nvidia.

Although Microsoft, Google, and Meta declined to touch upon whether or not they’re pursuing developments in supplies like insulators, Sundaram says these corporations might be extra keen to work with new US startups somewhat than defaulting to the previous methods of creating chips: “They’ve much more of an open thoughts about provide chains than the present large guys.”

[ad_2]

Supply hyperlink