[ad_1]

Within the digital age, banking apps have change into our monetary lifelines, providing ease and comfort for managing cash like by no means earlier than. But, with the fixed inflow of recent Fintech apps, choosing the proper one could be overwhelming. Whether or not you’re opening your first checking account or managing a number of, our information to the highest three iOS banking apps goals to simplify your alternative. Having personally navigated via all three, I’ve discovered that every serves its goal. We’ll delve into every app’s options, pricing, and customer support, providing you a transparent roadmap to choosing the app that most closely fits your monetary panorama. Let’s uncover the instruments that may redefine your banking expertise.

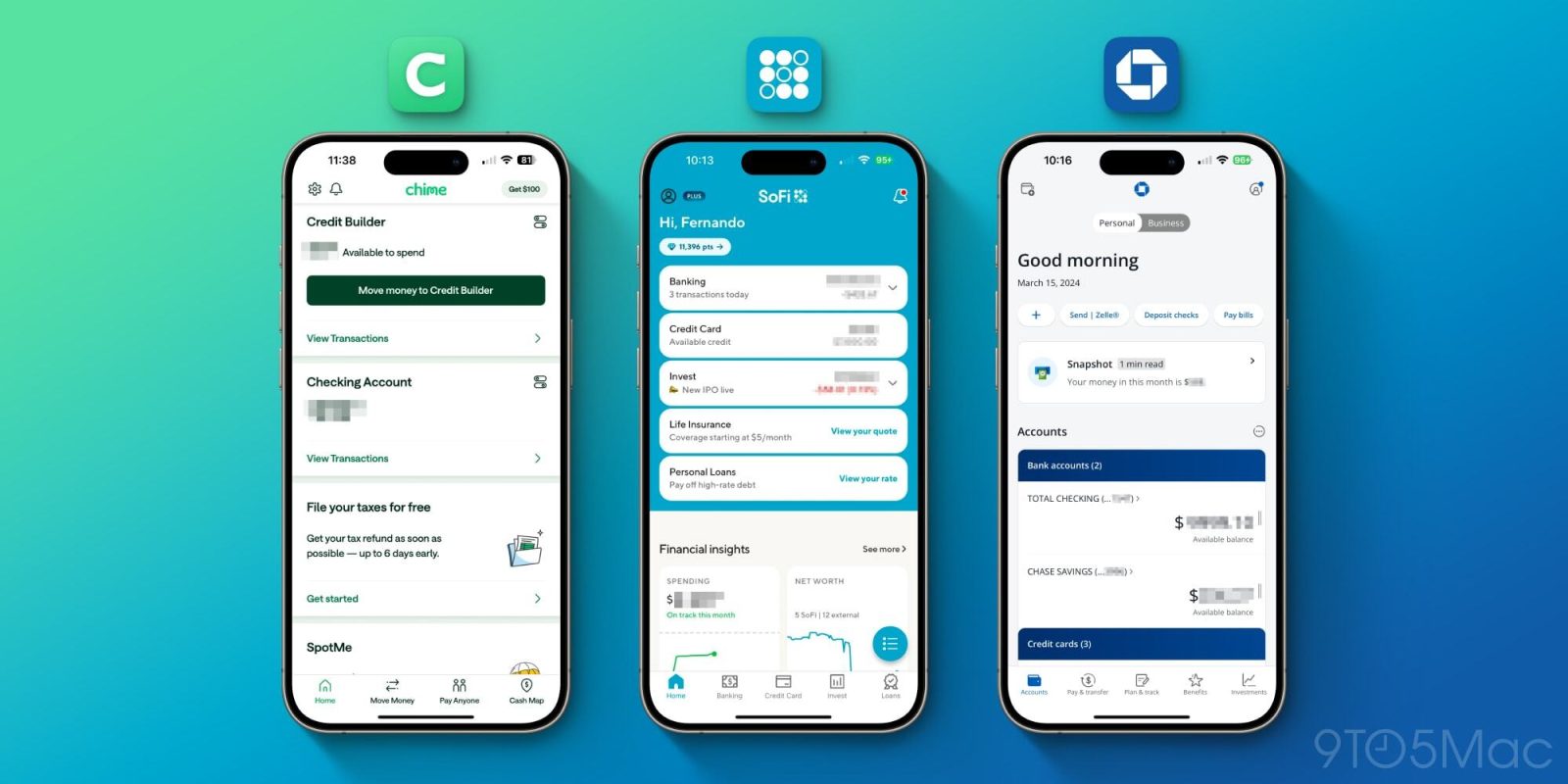

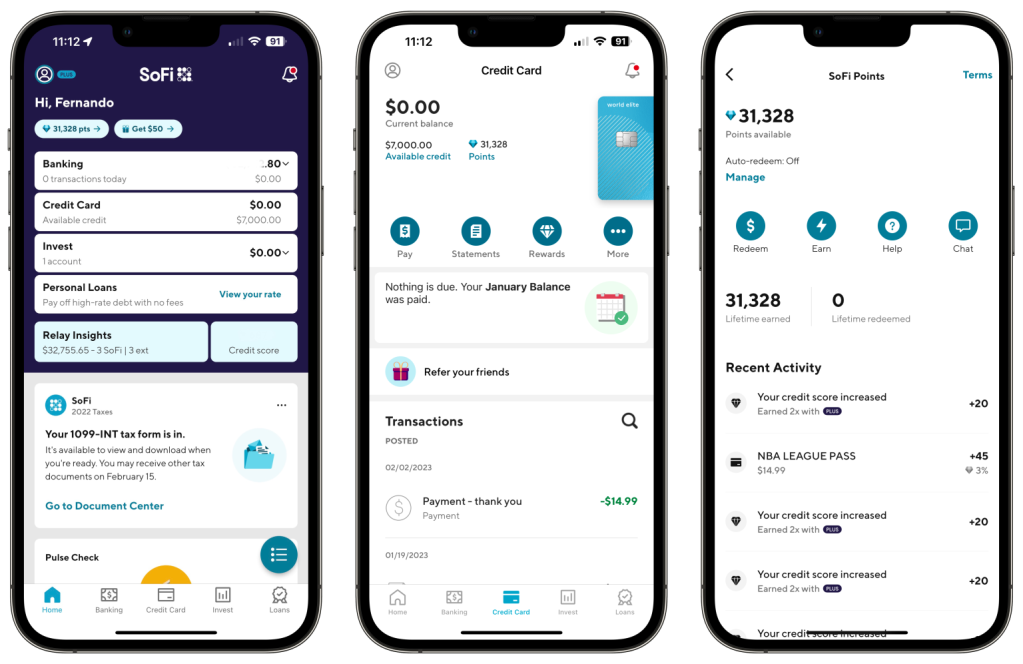

I’ve been with SoFi Financial institution for over two years, and it’s genuinely improved my method to managing funds. SoFi stands out by providing an array of companies that cater to just about each facet of economic planning with out the effort of conventional banking charges, the necessity for bodily branches, and the comfort of getting paid two days early.

One of many key sights for me has been SoFi’s compelling suite of merchandise. From private checking accounts with high-yield financial savings boasting an industry-leading 4.6% APY (As of March 2024), to mortgage loans, Roth IRAs, funding choices, bank cards, and even retirement planning, SoFi covers almost each monetary want. Their bank card alone is one in every of my favourite suggestions, providing you with 3% money again on the whole lot as a zero price card!

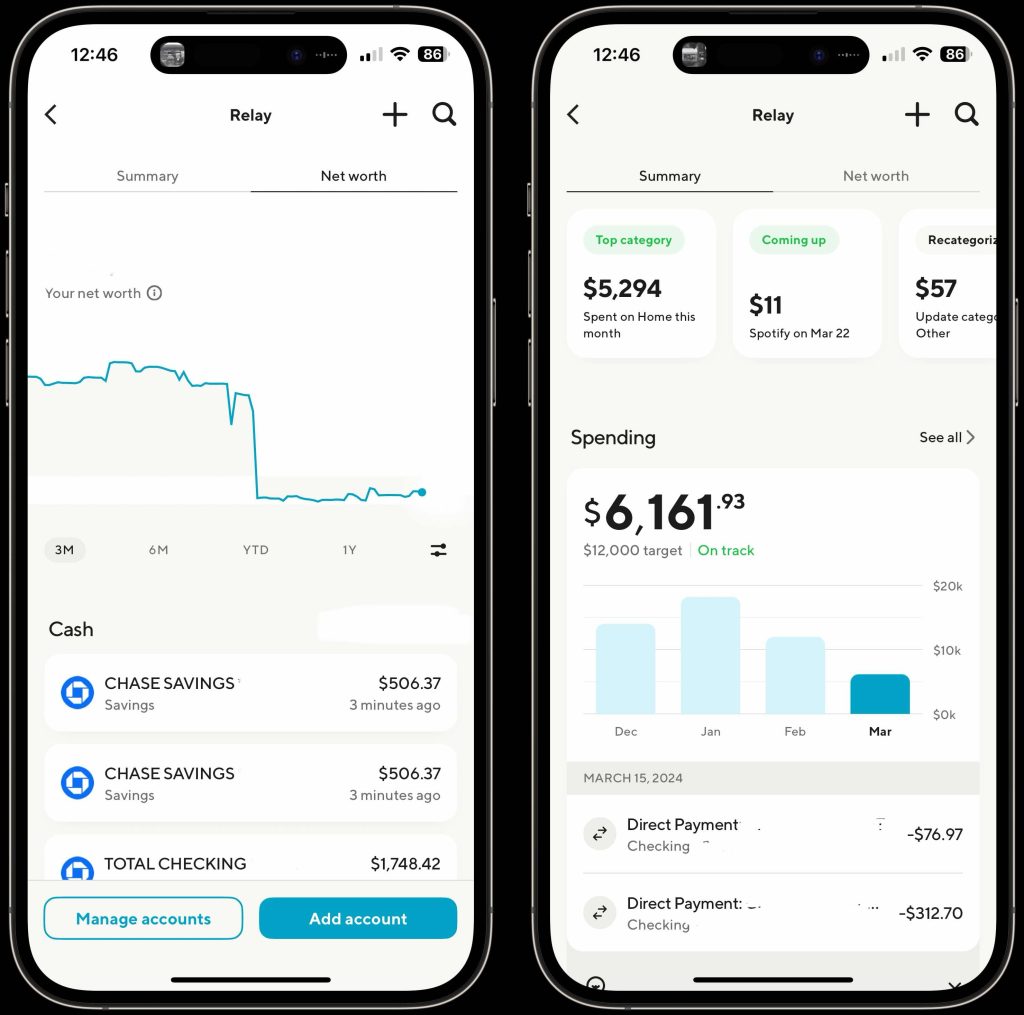

A very modern instrument that underscores SoFi’s fashionable method is the SoFi Relay product. This characteristic brilliantly bridges your whole monetary panorama, permitting you to hyperlink exterior financial institution accounts alongside your SoFi accounts. It transforms the app right into a central hub for monitoring bills, earnings, and even your web price, all up to date in actual time. This degree of oversight is invaluable for anybody seeking to take full management of their monetary well being.

The consumer expertise of the SoFi app itself is a testomony to the financial institution’s dedication to modernity and comfort. Its design is each aesthetically pleasing and functionally superior, making certain that navigating via your monetary information, whether or not it’s checking balances, monitoring investments, or setting financial savings objectives, is simple and hassle-free. The emphasis on a seamless and safe consumer interface, mixed with the excellent monetary overview offered by SoFi Relay, locations SoFi Financial institution on the forefront of next-generation banking options.

Execs

Function-rich & easy-to-use interface, 4.8 stars on the app retailer

Excessive-yield financial savings account – 4.6% APY

Vaults – used to routinely save for sure issues

ZERO charges, no transaction charges, late charges, overdraft charges, or month-to-month charges of any variety

Paycheck two days early

Investing platforms

Retirement planning

ATM community of 60,000 ATMs

Cellular verify deposit

Nice, zero-fee, newbie credit score card with 3% money again

Providing $25 for brand new Signal Ups

Free Credit score Rating

Cons

No bodily financial institution branches

No cashier checks

Depositing money is feasible however not supreme

Who ought to open a Sofi account?

SoFi is the best alternative for banking clients desirous to elevate their monetary administration. Its iPhone app combines simplicity with intuitive navigation, providing a variety of companies with out the complexity. Perfect for customers valuing a top-notch cell banking expertise over bodily branches, SoFi supplies high-yield financial savings and entry to extra monetary merchandise like investing and bank cards. This makes SoFi the proper platform for anybody seeking to seamlessly combine their banking and monetary progress.

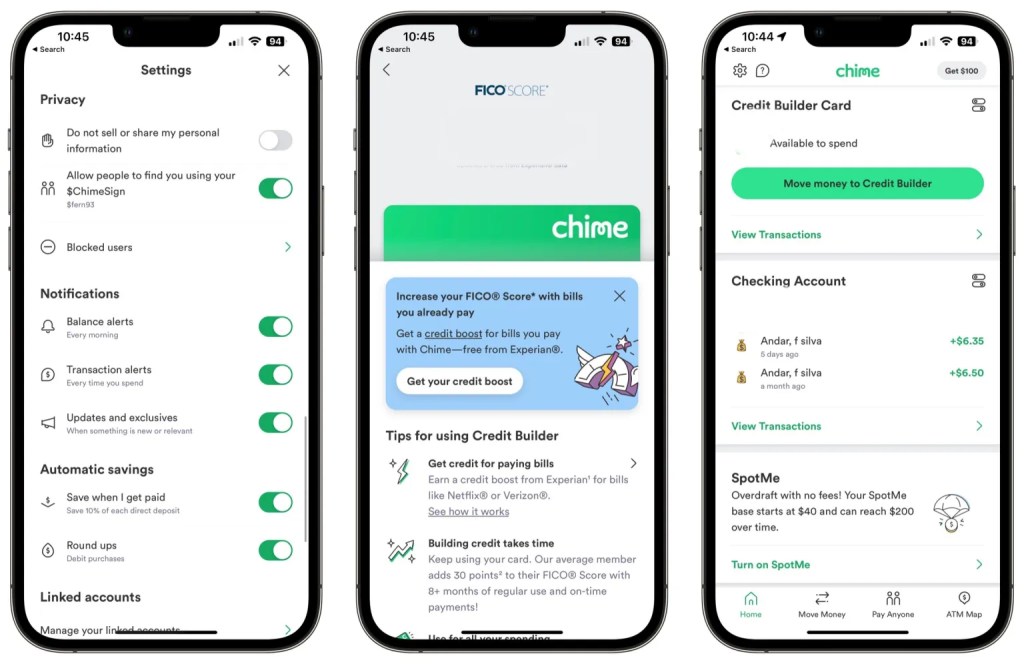

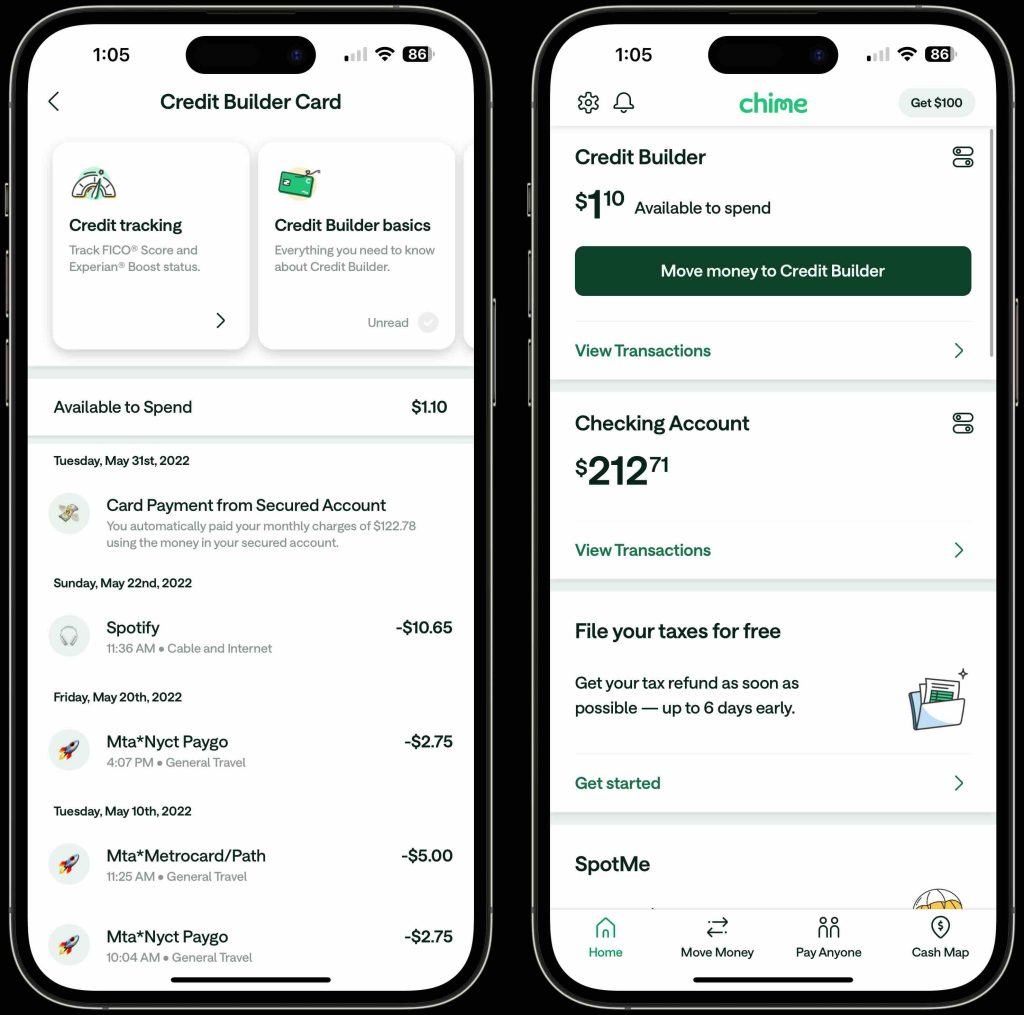

Whereas I’ve moved on from Chime as my go-to financial institution, it holds a cherished spot in my monetary historical past. I used to be with Chime for a strong 5 years earlier than switching to Sofi. Chime was like a crash course in adulting financially—it confirmed me the ropes on saving for the lengthy haul, constructing a strong credit score rating, holding on high of my payments, and an entire lot extra.

Chime is a complete no-brainer for rookies. Signing up is a breeze, and you’ll kiss goodbye to these sneaky hidden charges. The app is tremendous user-friendly, making it a chunk of cake to maintain your funds in verify. However the actual recreation changer? Chime’s credit score builder card. It’s a genius option to increase your credit score with out drowning in debt, because of a pay as you go system that ensures you’re at all times on time with funds. This credit score builder characteristic elevated my credit score rating immensely over the two years I had their Credit score Builder card. Plus, with a ton of free ATMs of their community, you received’t be forking out additional money on charges.

Execs

Extraordinarily user-friendly, 4.8 stars on app retailer

Chime Credit score Builder program – free bank card to assist construct your credit score

Receives a commission two days early

ZERO charges, no transaction charges, late charges, overdraft charges, or month-to-month charges of any variety

Spot Me service for overdraft safety as much as $200

Automated financial savings characteristic – Spherical up financial savings and automatic paycheck division

Disable misplaced or stolen card

View card information digitally

Cellular verify deposit

Free Credit score Rating

Cons

No bodily branches – if you’re somebody who likes to enter a financial institution, then this isn’t for you

Cellular verify deposit is simply accessible if enrolled in direct deposit

Not very product-rich. No funding platform, mortgage merchandise, insurance coverage platform, or mortgage choices

No cashier checks

Who Chime is for?

I jumped on the Chime bandwagon initially as a result of I used to be all about that slick consumer expertise and their trailblazing method to banking with out these pesky charges or the necessity for a bodily financial institution I’d by no means go to. What I used to be after was one thing strong I may run totally from my telephone, the place I may get my paycheck dropped straight in. As Chime upped its recreation, I bought hooked on their Credit score Builder, which pumped my credit score rating up by a candy 45 factors in only a 12 months by proving I may pay on time, each time.

This can be a golden ticket for anybody recent into the job market who wants a financial institution that’s straightforward to navigate, offers a leg up in constructing credit score, and lays down the fundamentals of saving with out making your head spin. Additionally, they’re throwing $100 your approach for those who join and arrange your direct deposit.

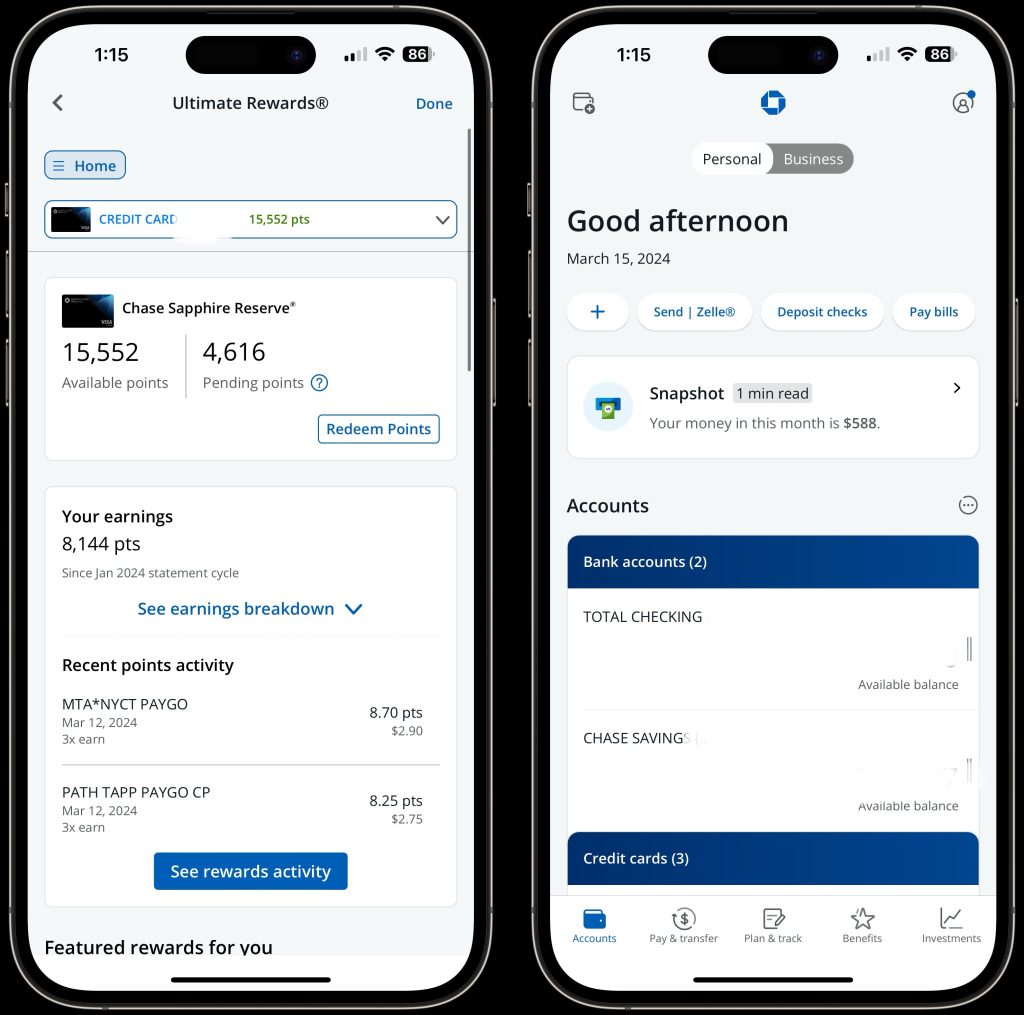

Chase Financial institution is the go-to for many who need the reliability of conventional banking with the comfort of a cutting-edge iOS app. It completely blends the consolation of bodily branches with digital innovation, making certain a seamless banking expertise for all clients. The app itself is a powerhouse, providing straightforward account administration, distant verify deposits, and personalised alerts. This digital instrument simplifies your monetary life, making it straightforward to remain on high of your cash with just some faucets.

Furthermore, Chase doesn’t cease at digital comfort—it’s a complete monetary hub. From mortgages and auto loans to pupil loans, Chase affords each monetary product you may want, making it extremely handy to handle all of your monetary affairs in a single place.

The cherry on high is the Chase Final Rewards program, which I’ve change into obsessive about. I’ve been in a position to e book enterprise class journey from US to Europe free of charge. It turns on a regular basis spending into factors that may be redeemed for luxurious journey, providing a world of free, high-end journey experiences. Right here is the cardboard I take advantage of for that!

Selecting Chase Financial institution means choosing a banking expertise that mixes custom with expertise and comfort with complete monetary companies, all whereas unlocking the potential for luxurious journey via good spending.

Execs

4.8 stars on app retailer

Big array of product choices

In depth bodily department community

Chase Final Rewards program

Big record of bank card choices to use for

Credit score rating instrument

cell verify deposit

Disable misplaced or stolen card

Legacy financial institution

Cons

Account minimums

Not free to open account

No actual HYSA possibility

Typically too many choices

Who’s Chase for?

Chase is the best choose for anybody who desires the most effective of each worlds: a slick, highly-rated iOS app for managing cash on the fly and the strong backup of conventional financial institution branches. It’s spot-on for tech lovers, savvy savers, and globe-trotters, providing a variety of economic companies from primary banking to rewarding bank cards. With Chase, you get a banking expertise that’s versatile and rewarding, tailor-made to suit a wide range of wants and existence, all whereas holding issues easy and accessible.

Wrap up

It’s clear which you can’t actually go improper with any of those cell banking choices. Chime served me properly for years earlier than I transitioned to SoFi, which has brilliantly met my evolving monetary wants—be it getting a bank card, planning for retirement, or diving into funding accounts. Switching gears to Chase Financial institution allowed me to maximise my spending and taught me easy methods to navigate the bank card recreation responsibly. Every of those platforms streamlines your monetary journey, providing unbelievable worth and empowering you to domesticate a optimistic relationship along with your cash. No matter the place you end up on the monetary spectrum, these apps stand able to bolster your cash administration with ease and experience. Let me know who you financial institution with and why and lets focus on within the feedback under.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.

[ad_2]

Supply hyperlink