[ad_1]

Apple Card

Apple Card has been obtainable for a number of years at this level, and it’s confirmed to be a very talked-about bank card. Regardless of its reputation, nonetheless, there are some things to remember earlier than signing up for Apple Card. Right here’s what you’ll want to know.

9to5Mac is supported by CardPointers: Obtain CardPointers without spending a dime and save over $750 per yr by maximizing your bank card rewards. 9to5Mac readers can save 30% on CardPointers Professional’s annual and lifelong plans and get a $100 Financial savings Card, successfully making the lifetime improve free.

Apple Card fast details

Apply and handle immediately within the Pockets app in your iPhone

Get a free Apple-designed titanium card

No late charges

No over-limit charges

No overseas transaction charges

Created by Apple with a monetary back-end powered by Goldman Sachs

All funds due on the final day of the month

Discover out if you happen to’re accredited with solely a tender credit score test

Apple Card Financial savings Account

Apple Card perks

The Apple Card gives a set of rewards and perks that make it engaging for just a few completely different causes. The headlining characteristic is the power to earn “Limitless Day Money again” on each buy. The quantity of that money again, nonetheless, varies by the place and the way you make that buy.

3% Day by day Money again on each buy from Apple Shops, Apple’s web site, and all digital purchases from the App Retailer, iTunes, and Apple companies like Apple Music and Apple TV+

2% Day by day Money again on all purchases made utilizing Apple Pay on-line and in-store

1% Day by day Money again on all different purchases

You too can get 3% Day by day Money again while you purchase with Apple Pay at a number of particular shops and retailers:

Ace {Hardware}

Exxon

Nike

T-Cellular

Uber Eats

Duane Reade

Mobil

Panera Bread

Uber

Walgreens

Apple Card Month-to-month Installments

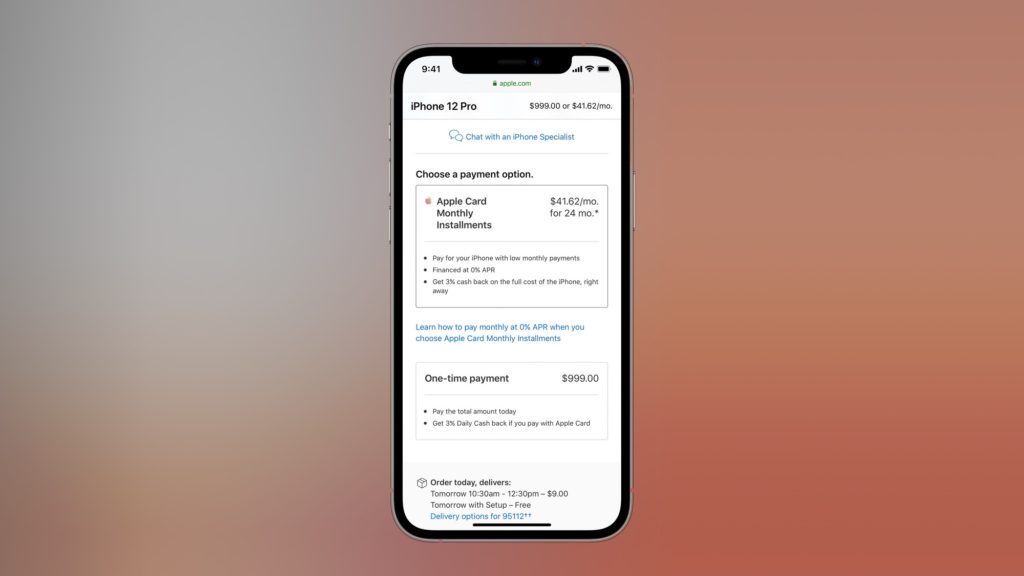

One other of the good perks of Apple Card is the “Month-to-month Installments” characteristic that lets you finance any buy of Apple merchandise over time with zero-percent curiosity.

When you’re an Apple Card consumer, you’ll see an “Apple Card Month-to-month Installments” financing choice. You may finance just about any Apple product utilizing this selection, together with all of Apple’s major product classes:

iPhone: Finance throughout 24 months

Mac: Finance throughout 12 months

iPad: Finance throughout 12 months

Apple Watch: Finance throughout 24 months

AirPods: Finance throughout 6 months

Apple TV 4K: Finance throughout 6 months

When you commerce in an iPhone in direction of the acquisition of a brand new iPhone, the worth of that trade-in might be immediately deducted from the acquisition worth of the brand new iPhone, reducing your month-to-month installment.

You additionally earn 3% Day by day Money on all Apple Card Month-to-month Installment purchases. For example, if you happen to purchase an iPhone 14 for $799, you get the complete 3% Day by day Money, or roughly $24, deposited straight away, regardless that you haven’t truly paid for the gadget but.

There is no such thing as a approval course of required for Apple Card Month-to-month Installments. As an alternative, the stability of your installments counts in direction of your total Apple Card credit score restrict. For example, when you’ve got a credit score restrict of $5,000 and you fiscal an iPhone 14 from Apple, the price of that iPhone 14 is subtracted out of your total credit score restrict.

What’s Day by day Money?

“Day by day Money” is what Apple calls the money again that you simply earn with Apple Card purchases. You earn the Day by day Money proper after the acquisition posts to your Apple Card stability. That is completely different than many different money again playing cards, which don’t give the money again till the tip of every assertion cycle.

By default, Day by day Money is deposited on to your “Apple Money” stability. Apple Money is a separate card within the Pockets app that’s successfully Apple’s competitor to different cost companies like Venmo and Money app.

Cash in your Apple Money account can be utilized for Apple Pay purchases, despatched to family and friends through Messages, or transferred to your linked checking account. You too can use your Apple Money funds to pay down the stability of your Apple Card itself.

Another choice obtainable is to have Day by day Money rewards instantly utilized to your Apple Card’s stability. This works if you happen to don’t have an Apple Money account.

Most not too long ago, Apple launched Apple Card Financial savings Account. It is a new characteristic unique to Apple Card customers. You may have your Day by day Money deposited to the financial savings account immediately, which gives 4.15% curiosity, and make deposits from a linked checking account.

Apple Card safety and privateness

Apple Card additionally gives a handful of safety and privateness options that may assist shield your info and funds to forestall unauthorized transactions.

Superior Fraud Safety: The Card Safety Code routinely refreshes day-after-day.

No card quantity or safety code on the bodily card itself

Capacity to lock your Apple Card through the Pockets app

Actual-time transaction notifications through the Pockets app

Is the Apple Card price it?

Now that we’ve run by the advantages and options of Apple Card, we will speak about whether or not or not it’s price it.

For a card with no annual charge, the Apple Card has some engaging perks and reward choices – particularly for individuals who discover themselves spending a good amount of cash with Apple immediately.

The Apple Card is price it if the next issues apply to you:

You aren’t involved concerning the potential one-time hit to your credit score rating.

Apple Pay is extensively accepted as a cost choice from the shops and web sites you store.

You purchase merchandise from Apple, the App Retailer, and Apple Providers.

You may responsibly make the most of the Apple Card Month-to-month Installments choice for 0% financing on Apple merchandise.

You worth the power to handle all the pieces through the Pockets app in your iPhone.

There’s additionally an online interface for Apple Card, however the Pockets app is the easiest way to handle Apple Card.

That’s to not say the Apple Card is a must have bank card, although. There are equally aggressive money again choices from the likes of Chase, Citi, and Uncover. You too can try choices from American Specific, lots of which supply extra engaging rewards so long as you know the way to greatest redeem the Membership Rewards factors.

I acquired the prospect to speak with Emmanuel Crouvisier, developer of the standard CardPointers app, concerning the Apple Card. CardPointers is a wonderful app for iPhone, iPad, and Mac that will help you maximize bank card rewards.

There are such a lot of extra benefits to an excellent rewards card, like a Chase Freedom, Sapphire Most popular, Citi Premier, or Amex Gold card. With these playing cards you possibly can earn transferable factors which you’ll switch to airways and resorts to get much more worth out of the factors that you simply earn — and their factors multipliers for many classes are a lot increased than the Apple Card, too.

With the Apple Card essentially the most you will get is 3% again in your buy, whereas with the playing cards I’ve talked about, you will get 5x again in factors on some classes like eating places, gasoline stations, and many others, and people factors are price much more as you possibly can redeem them for issues like enterprise class seats to Europe.

If somebody spends $10,000 on their Apple Card in a yr they’ll get again at most $300, whereas the identical $10k spend on an excellent rewards card can earn them 50,000 factors, and people factors may be price 4c or extra with an excellent redemption, which means the actual worth could be $2,000. Actually, 7x extra worth out of utilizing an excellent rewards card, and that’s what CardPointers helps customers do — earn extra from each buy simply by paying with the fitting card.

Even if you happen to simply need to concentrate on money again, different playing cards can earn the identical money again because the Apple Card on much more classes and retailers. I’d like to see the Apple Card additional enhance their earnings classes, and increasingly more banks are doing offers immediately with particular retailers as a type of promoting, so I believe we’ll proceed to see extra of that throughout all playing cards as a brand new income for them.

9to5Mac readers can save 30% off the conventional worth of CardPointers and get a $100 Financial savings Card as a signup bonus.

Wrap up

As all the time, bank cards are solely a large monetary instrument if you happen to pay them off each month. When you begin carrying a stability and paying curiosity, the bank card firm is making a living off you. The rewards you obtain won’t ever outweigh the curiosity costs.

Personally, I discover the Apple Card to be an important choice to have for choose Apple Pay purchases and my Apple purchases. My each day drivers, nonetheless, proceed to be the American Specific Gold Card and Blue Enterprise Plus.

What are your ideas on Apple Card? Are you an Apple Card consumer already or are you contemplating making use of? Tell us down within the feedback.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.

[ad_2]

Supply hyperlink